Fee

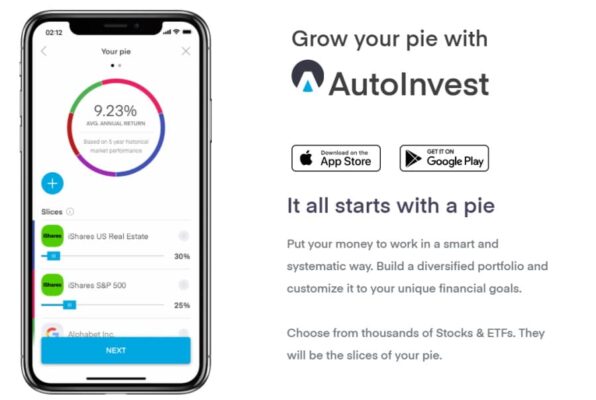

A Trading 212 Invest account allows you to trade stocks and ETFs completely free of charge. Just bear in mind that if the stock/ETF is in a different currency than your base one, you will incur a 0.15% currency conversion fee for each transaction.

When you deposit money via a debit/credit card or digital wallet, you will pay no fees until the total deposited amount reaches EUR 2000, but a 0.7% fee will apply thereafter. Note that you will have to deposit at least 10 euros each time for Trading 212 to accept it.

If you must deposit a large amount, it may be less expensive to wire transfer which will cost 10 euros instead. But check on what your bank charges for wire transfers before you go with this option.

There are no withdrawal fees for this account type.

Commissions

If you go with a Trading 212 CFD account, the transaction cost for Forex will depend on the underlying pair as each one has a different spread. But the broker charges a standard 0.5% conversion fee.

You will not be charged anything for depositing funds but a minimum deposit amount of 10 euros is required.

If you leave a position open overnight, you will be charged an interest SWAP.

Payment Methods

Deposit and withdrawal

When depositing money into your account, it’s free with a bank transfer, and these are instant too.

You can also deposit by card (and Google pay), and this is free up to £2,000. After that it’s 0.7%.

There’s no withdrawal fees either, or inactivity fees (which you can find on other platforms).

Asset on Trading 212

Trading 212 Invest

With Trading 212 Invest, you can trade stocks and ETFs for free. Its offerings here may not be as many as other online brokers offer, but there are thousands of them so chances are you will find what you’re looking for; especially if it’s listed on a major exchange.

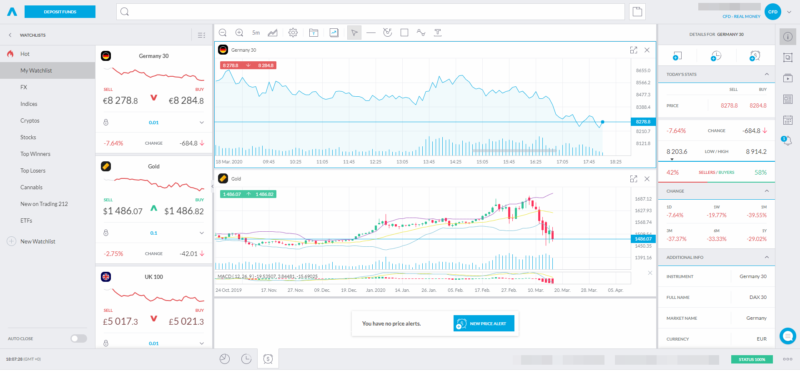

Trading 212 CFD

With Trading 212 CFD, you get access to CFDs (contracts for difference) which are the type of asset that Trading 212 started offering when it was founded back in 2005.

You can buy CFDs on forex, stocks, indices, and commodities. The assets available for CFD trading are thousands.

Note: A contract for difference is an agreement between a buyer and a seller that stipulates that the buyer or seller will pay the other party the difference between the opening and closing price of an underlying security.

Who pays whom is determined by the direction of the underlying security’s price. If you buy a CFD on a stock that you think is going to appreciate in value, whoever sold you the CFD will have to pay you the difference between the price the stock was trading at when you bought the CFD and the price it had when you closed your position.

No problem if you don't want this. I just thought that it may be useful for beginners.

Customer Support

Customer support on Trading 212 is very good both in regards to their process for resolving your issue and availability.

You can get in touch with them via live chat or email. Phone support is not available, unfortunately. The bright side is that you can contact them 24/7.

Just bear in mind that you will be asked to fill out a form if you require support through email. But that’s good since your question can be answered by going through the relevant articles that will be recommended once you fill out the form.

FAQ

Is there an inactivity fee on Trading 212?

No. trading 212 does not charge its clients an inactivity fee.

How does Trading 212 make profit?

The spreads between the buy and sell prices on Trading 212's assets are how they generate money. In addition, there is a 0.5% currency conversion fee, as well as stamp duty on ETF and share purchases.

Does Trading 212 make me own my shares?

Trading 212 holds the shares clients have on their behalf. The equity is held in custody at Interactive Brokers when you invest with Trading 212. These are among the largest brokers in terms of daily trades, with $160 billion in client assets.

Can I create more than one trading account?

On Trading 212, you can’t create and maintain 2 active accounts using the exact same information. If you are a UK-based client, you get to use the same email address and name to open a, CFD, Invest, and ISA.